What to know about gas prices, what's driving up the price, and a future threat lurking therein

A look at supply, demand, historical pricing, profits, oil industry surveys, and earnings calls shows production and inflation don't explain the prices. The answer reveals a future economic threat.

Sections

Prices mostly follow supply and demand but not right now

Gas production is the highest it’s been in decades

What actions have lawmakers taken to lower prices?

What does the oil industry say is the cause?

Where is all this extra cash going? Buybacks, of course.

LISTEN: Companies and elected officials blame policies while telling investors the increases are intentional

Introduction

Like most Americans, you probably have that person in your family transfixed upon gas prices—maybe it’s you. Here's the data analysis for the person interested in every possible angle on gas prices in the US.

Prices mostly follow supply and demand but not right now.

The most popular comparison, particularly among partisans, is one between Memorial Day 2020 and Memorial Day 2022. The COVID-19 pandemic artificially lowered demand in 2020 via travel restrictions. At the same time, oil companies took massive losses. The two dates are a dramatic comparison precisely because they aren’t comparable, but if we use Memorial Day 2020, we must use 2020 data in all circumstances.

Another example of an unfair 2020-to-2022 comparison is comparing the 15% unemployment rate in 2020 to that of 2022. The percentage is now around 3.5 (US Bureau of Labor and Statistics, 2022). Still, if you make the gas price comparison using 2020 and 2022, you must use it for all other comparisons; otherwise, this is propaganda. Be consistent.

In the interest of an honest comparison, in 2019, the high price hovered around $4/gallon on Memorial Day (DiChristopher, 2019).

The average plummeted during COVID to under $2/gal (Gross, 2020), and companies took massive losses per barrel (Englund, 2021). In 2020, the price per barrel had fallen to $39.68 (US Energy Information Administration, 2022). Larger companies said they need per-barrel prices of just $49 to turn a profit (Egan, 2022).

In 2021, the year's close price of $68.17 was very similar to 2018, when the price per barrel closed at $65.23–except with inflation, the closing price in 2021 is lower (US Energy Information Administration, 2022).

In 2008, the adjusted-for-inflation peak price per gallon was around $4.30, but the price per barrel had an adjusted price of $187.04 (McMahon, 2022; US Official Inflation Data, 2022).

In 1981, the adjusted price per barrel broke $125, while the adjusted peak gas price was around $4.30, like in 2008.

In 2012 the adjusted price per barrel broke $133. The inflation-adjusted peak gas price in the same period was around $4.40.This demonstrates that the pricing increases are greater than they have been historically. The next question is why. This could be explained in several ways, increased regulations, decreased production, or some combination, so let’s look.

Gas production is the highest it’s been in decades

Production has not meaningfully changed between the current and the former President, but still, we see an all-time high price of $5/gal (Sanicola, 2022).

America produced 11.185 million barrels of crude oil daily in 2021, compared with 11.283 million a year earlier under Trump (Cercone, 2022).

The amount produced in Biden’s first year exceeds the average daily amount produced under Trump from 2017 to 2018, according to data from the US Energy Information Administration (Cercone, 2022; EIA, 2022).

What have elected officials done about prices?

There are around 9000 unused drilling permits, although it’s not that everyone is choosing not to (some are doing that). To encourage supply, the Biden administration has issued more permits on federal lands than the previous administration in any of the first three years (Loe, 2022). This has been criticized by environmental activists (AP News, 2021).

Various other causes explain some unused permits, like pending legal cases and supply chain bottlenecks for materials like piping. Still, the industry could meaningfully increase the supply in the US were they so inclined.

The war and global inflation will affect the US, but America gets less than 2% of its oil supply from Russia (Russian oil embargoes will influence energy prices internationally and drive up prices to varying degrees depending on the country). In May of 2022, the House passed the Gas Price Gouging Prevention Act in a 217-207 vote. All Republicans and four Democrats opposed it (Daly, 2022).

The bill intended to prevent price gouging of customers by oil companies and allowed the government to fine companies for doing this (Gas Price Gouging Prevention Act, 2022). A valid criticism of the bill is that it is vague. This does not appear to be what has stalled the bill in the Senate, though. Elected officials may and often do propose revisions to get legislation passed.

Although a supermajority of Americans supported the bill, it remains stalled in the Senate and unproved by its Republican members. Morning Consult found that energy price-gouging legislation is supported by 77% of registered voters, including 83% of Democrats and 76% of Republicans (Martinez, 2022).

Effectively, the US has Senators who are both condemning gas prices and blocking action to prevent price gouging. Lawmakers hauled industry executives into Congress for testimony in April 2022 (CSPAN, 2022). That said, many elected officials

The Keystone XL pipeline

A common line of inquiry involves the Keystone XL pipeline, which President Biden canceled. The concerns about Keystone XL often included claims that the US was energy independent until the current President came into office. Industry lobbyists have appeared on popular news channels making claims the data don’t support, attributing the price increase in the US to policy—but what policy and how it’s increasing the prices are never stated.

This is false. There are no energy-independent countries—only net exporters of energy, which the US was in 2021 and will remain so in 2022, in all likelihood. Bloomberg Markets reported in February:

Oil output will average 12.6 million barrels a day in 2023, an increase from its previous estimate of 12.41 million, according to Energy Information Administration data. The current annual all-time high of 12.3 million barrels a day was set in 2019.

AFP, one of the most reliable fact-checking organizations, assessed similar claims and found:

The Keystone XL pipeline project, which Biden canceled on his first day in office, would have delivered more Canadian oil to US refineries, with much of the refined products likely to be exported. By adding to both imports and exports, this project "would be a wash for the trade deficit," Finley said.

The proposed pipeline completion would have swapped some crude oil imports with Canadian imports without impacting the overall trade picture, according to Finley: "It would displace other forms of crude oil from Mexico or possibly Venezuela and wouldn't change the domestic balance."

What does the oil industry say is the cause?

A survey of 132 oil and gas firms shows investor pressure is the biggest restraint on increasing supply. About 60% of respondents answered, “What is the primary reason that publicly traded oil producers are restraining growth despite high oil prices?” with “investor pressure to maintain capital discipline” (Plante & Patel, 2022).

Just 6% of oil executives reported to the Dallas FeReserveeserve said government regulations were the primary reason they were not increasing production. In total, 88% of the inaction on increasing supply comes down to company choice, according to oil executives themselves. Critically the Dallas Federal Bank survey notes (Plante & Patel, 2022):

It is looking unlikely that (increased supply) will happen, which will result in sustained higher energy prices until the American consumer is pushed into a recession.

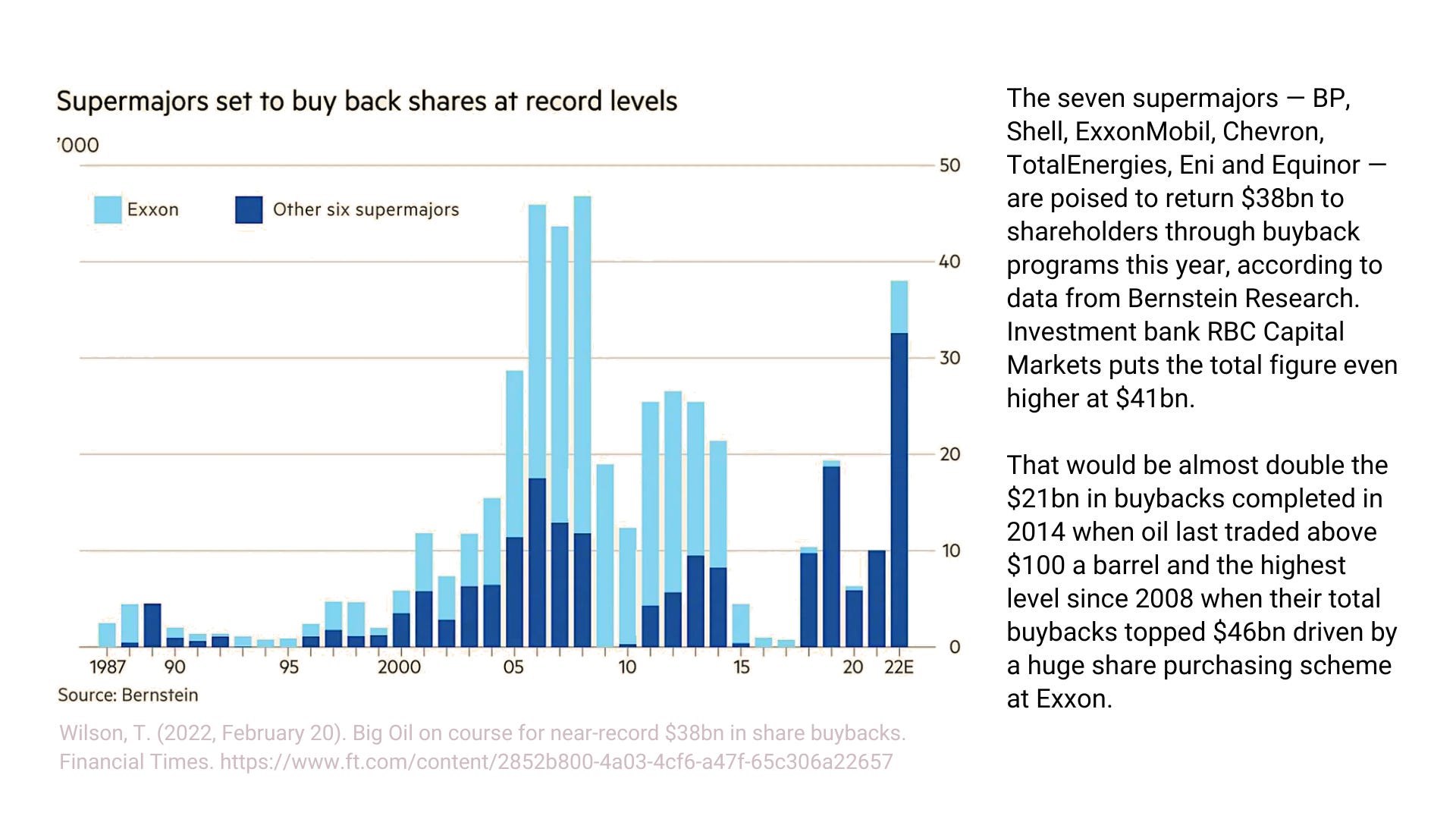

Where is all this extra cash going? Buybacks.

An analysis of Securities and Exchange Commission filings for 100 US corporations found net profits up by a median of 49%, and in one case, by as much as 111,000% (Perkins, 2022). That’s a lot of money, so the question became, what are they doing with it? Buybacks were explained and strongly condemned in a 2020 analysis from the Harvard Business Review (Lazonick et al., 2020):

With the majority of their compensation coming from stock options and stock awards, senior corporate executives have used open-market repurchases to manipulate their companies’ stock prices to their own benefit and that of others who are in the business of timing the buying and selling of publicly listed shares. Buybacks enrich these opportunistic share sellers — investment bankers and hedge-fund managers as well as senior corporate executives — at the expense of employees, as well as continuing shareholders.

Many companies that will spend the surplus from price-gouging on buybacks in 2022 also spent the surplus from tax breaks on buybacks after 2017 (Useem, 2019; Wilson, 2022).

Here’s why that matters.

Taxes for corporations were slashed from 35% to around 20% citing economic benefits. Penn Wharton, widely regarded as the best business school in the country, said of the effects of the 2017 cuts (Paulson, 2018):

By 2040, we project that GDP contracts by 0.6 percent to 0.9 percent relative to current law, where the tax cuts for individuals are set to expire. Debt increases between $5.2 trillion and $6.1 trillion.

To date, little of the promised economic benefit and many buybacks while adding to the federal debt. The additional debt is saddled upon the middle and upper-middle class with the taxes, which fund the public goods, infrastructure, law enforcement, sanitation, and more, that make the country desirable (Horsley, 2019; Lazonick et al., 2020; Paulson, 2018; The Budget and Economic Outlook: 2019 to 2029, 2019).

Two major surges in stock buybacks will put the US economy at risk by “rendering these businesses more financially fragile in subsequent downturns when abundant profits disappear” (Lazonick et al., 2020). Should that happen, the middle class will likely again be forced to bail out these same businesses now extracting from the American public writ large (Egan, 2022; Grantham-Philips, 2022; Sanicola, 2022).

Companies and elected officials blame policy, but their words and evidence don’t support the claim.

Investor calls show companies intentionally keeping prices. This happens at the same time lawmakers have falsely claimed that climate policies explain the increase. As discussed above, only 6% of oil executives cited environmental policies as restricting supply (Plante & Patel, 2022).

Some companies like Diamondback indicate they won’t risk lowering profits by increasing supply (Documented, 2022). Occidental Petroleum said there was no need to increase supply, implying that the company is now pleased with profits.

Companies are are keeping prices high intentionally, according to the companies in phone calls.

Many companies have admitted to choosing not to increase supply to keep profits high. Examples are included below. Where possible, the audio from the call or interview has been included so you can hear it from the executives directly. Documented, an investigative journalism group focused on corporate influence, collected excerpts (Documented, 2022).

Marathon Oil

"Our cash flow-driven return of capital framework uniquely prioritizes our shareholders as the first call on cash flow generation, not the drill bit."

"I want to make clear that should commodity prices continue to surprise to the upside, we will remain disciplined and have no plans to allocate production growth capital."

Pioneer Natural Resources

"We expect to generate over $10.5 billion of operating cash flow, which will be a record for the company."

"Long term, we're still in that 0% to 5%. It's going to vary. We're not going to change, as I said. At $100 oil, $150 oil, we're not going to change our growth rate. We think it's important to return cash back to the shareholders."

Occidental Petroleum

"As evidenced by our guidance for 2022, we do not intend to grow production in 2022. At the point where it is appropriate to invest in future cash flow growth, we will only do so if supported by long-term demand."

Listen

Diamondback Energy

"I can tell you definitively right now what's being valued by our investors is a shareholder return program. And no one wants to see that shareholder return program put at risk with volume growth, not for Diamondback, specifically for our industry in total...

"We've spent the last decade consuming capital and now we've got a little bit of sunshine in us where we can return that capital to our investors that have been waiting patiently and sometimes impatiently for this return."

Listen

Oil CEOs cashing in on a .crisis

Of course, CEOs are not simply trying to save face with investors. In addition to industry-wide record profits, individual executives have grown their personal wealth. As BailoutWatch recently reported, oil and gas executives have cashed out millions since the start of the war.

Marathon Oil, Pioneer Natural Resources, Occidental Petroleum, and Diamondback Energy are hardly industry outliers. Their peers are committed to robust shareholder returns, record cash flow, and slow growth.

Devon Energy - February 16, Q4 earnings call

With this powerful stream of free cash flow, we delivered on exactly what our shareholder-friendly business model was designed for, and that is to leave the industry in cash returns. As you can see on the graphic, we rewarded shareholders with outsized dividends, opportunistic share buybacks, and we took meaningful steps to strengthen our investment-grade balance sheet...

What I was just going to add, remember that we are growing in the Permian. At the same time, we're keeping our overall production flat.

Laredo Petroleum - February 23, Q4 earnings call

Our capital investments are disciplined and are being allocated to our best opportunities. We are fortunate to have a strong portfolio of high-return oil projects in the US's premier oil basin. We are maintaining our capital discipline, keeping activity levels flat from 2021, keeping oil production approximately flat from our Q4 '21 exit rate.

APA Corporation - February 22, Q4 earnings call

By maintaining capital discipline and investing in a level slightly below our plan, we let the strengthening oil price flow directly through to the balance sheet reducing upstream net debt in 2021 by $1.2 billion. In one year, we accomplished what we thought would take multiple years and made great progress toward our goal of returning to investment-grade status...

With $6.5 billion of projected free cash flow, we will return $4 billion to shareholders under our current framework, that leaves $2.5 billion for debt reduction or additional shareholder returns through buybacks and/or dividend increases.

Continental Resources - February 15, Q4 earnings call

First, thanks to our capital discipline and the strength of our operations and execution, we generated record quarter-over-quarter free cash flow for the last four quarters and a record full-year free cash flow of $2.64 billion...

We are projecting significant cash flows with over 55% of cash flow from operations available to shareholders in the form of net debt reduction, dividends and share repurchases...

Our projections are based on a flat year-over-year CapEx relative to 2022, delivering a low single-digit compound annual production growth rate. We are targeting significant cash flow and dividend per share growth over this time frame.

Hess Corporation- January 26, Q4 earnings call

As a reminder, as you've said earlier, we've been consistent in saying that our cash flow compounding, as it does, we intend to return the majority of our free cash flow to our shareholders by further increasing our dividend and also accelerating share repurchases.

EOG Resources - February 25, Q4 earnings call

2021 was a record-setting year for EOG. We earned record net income of $4.7 billion, generated a record $5.5 billion of free cash flow, which funded record cash return of $2.7 billion to shareholders. We doubled our regular dividend rate and paid two special dividends, paying out about 30% of cash from operations...

This period of high oil prices allows us to further bolster the balance sheet. To support our renewed $5 billion buyback authorization and prepare to take advantage of other countercyclical opportunities, we plan to build and carry a higher cash balance going forward...

We don't need more inventory. We are focused on improving our inventory quality.

Supplementary data and images

Figure 1. Dallas Fed Energy Survey shows “Wall Street demands profits”

Figure 2. Big Oil is on course for a near-record $38bn in share buybacks.

Figure 3. Field Production of Crude Oil (Thousand Barrels)

Figure section 4. Crude oil prices over time

Figure section 5. Non-adjusted crude oil pricing and production

Figure 6. Public lands drilling permits from 2017 to 2021.

Figure 7. Yes, there are 9000 unused drilling permits

Oil Executives Testify on High Gas Prices on April 6, 2022

References

Hoaxlines notebook for the report.

AP News. (2021, July 13). Biden Promised To End New Drilling On Federal Land, But Approvals Are Up. NPR. https://www.npr.org/2021/07/13/1015581092/biden-promised-to-end-new-drilling-on-federal-land-but-approvals-are-up

Cercone, J. (2022). PolitiFact - Oil production in Biden’s first year on par with Trump. Politifact. https://www.politifact.com/factchecks/2022/mar/09/facebook-posts/oil-production-bidens-first-year-par-trump/

CSPAN. (2022, April 8). Oil Executives Testify on High Gas Prices. US Congress. https://www.c-span.org/video/?519140-1/oil-executives-testify-high-gas-prices

Daly, M. (2022, May 19). House passes bill to crack down on gasoline “price gouging.” Associated Press. https://apnews.com/article/russia-ukraine-biden-congress-climate-and-environment-199c935b6c81b6520c39fbf2791b899b

DiChristopher, T. (2019). Soaring gasoline prices peak just in time for Memorial Day weekend. https://www.cnbc.com/2019/05/24/soaring-gasoline-prices-peak-just-in-time-for-memorial-day-weekend.html

Documented. (2022, March 17). Let No Crisis Go to Waste: Investor Calls Reveal Oil Execs Relishing in Windfall from High Prices. Documented: Investigating Corporate Influence. https://documented.net/investigations/investor-presentations-reveal-oil-executives-have-no-plans-to-increase-drilling

Gas Price Gouging Prevention Act, 3920, Senate, 117th Congress (2022). http://www.congress.gov/

Egan, M. (2022, March 17). Big oil catered to shareholders while Americans were hit with surging gas prices. CNN. https://www.cnn.com/videos/business/2022/03/16/fossil-fuel-companies-shareholders-oil-production-gas-prices-the-lead-vpx.cnnbusiness

EIA. (2022). US Field Production of Crude Oil (Thousand Barrels per Day). US Energy Information Administration. https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfpus2&f=a

Englund, W. (2021, February 4). Oil companies’ losses in 2020 were staggering. And that was before the government focused on climate change. The Washington Post. https://www.washingtonpost.com/business/2021/02/04/exxonmobil-oil-company-losses/

Gorski, D., & Yamey, G. (2021, September 13). Covid-19 and the new merchants of doubt. The BMJ. https://blogs.bmj.com/bmj/2021/09/13/covid-19-and-the-new-merchants-of-doubt/

Grantham-Philips, W. (2022, May 7). Oil giants reap record profits as war rages in Ukraine, energy prices soar: Here’s how much they made. USA Today. https://www.usatoday.com/story/money/economy/2022/05/07/oil-company-record-profits-2022/9686761002/

Gross, A. (2020). Motorists to see Cheapest Memorial Day Pump Prices in Nearly Two Decades. AAA. https://newsroom.aaa.com/2020/05/motorists-to-see-cheapest-memorial-day-pump-prices-in-nearly-two-decades/

Holden, E. (2020, May 21). US critics of stay-at-home orders tied to fossil fuel funding. The Guardian. https://amp.theguardian.com/environment/2020/may/21/groups-fossil-fuel-funding-urge-states-reopen-amid-pandemic

Horsley, S. (2019, December 20). After 2 Years, Trump Tax Cuts Have Failed To Deliver On GOP’s Promises. NPR. https://www.npr.org/2019/12/20/789540931/2-years-later-trump-tax-cuts-have-failed-to-deliver-on-gops-promises

Lazonick, W., Sakinç, M. E., & Hopkins, M. (2020, January 7). Why Stock Buybacks Are Dangerous for the Economy. Harvard Business Review. https://hbr.org/2020/01/why-stock-buybacks-are-dangerous-for-the-economy

Loe, M. (2022, March 21). Biden claimed 9,000 oil drilling permits are unused. That’s true, but all work can’t begin “right now.” VERIFY. https://www.verifythis.com/article/news/verify/national-verify/oil-permits-9000-unused-fact-check/536-2a657e09-856b-436c-a55d-df1cdf2acb3f

Martinez, J. (2022). Broad bipartisan support among voters for a federal government ban on energy price gouging. Morning Consult. https://morningconsult.com/2022/05/25/gas-price-measures-survey/

McMahon, T. (2022, June 2). Inflation Adjusted Gasoline Prices. InflationData.com. https://inflationdata.com/articles/inflation-adjusted-prices/inflation-adjusted-gasoline-prices/

Paulson, M. (2018, April 12). The Tax Cuts and Jobs Act: Extending Changes to Individual Taxes —. Penn Wharton Budget Model. https://budgetmodel.wharton.upenn.edu/issues/2018/4/11/the-tax-cuts-and-jobs-act-extending-changes-to-individual-taxes

Perkins, T. (2022, April 27). Revealed: top US corporations raising prices on Americans even as profits surge. The Guardian. https://amp.theguardian.com/business/2022/apr/27/inflation-corporate-america-increased-prices-profits

Plante, M., & Patel, K. (2022). Dallas Fed Energy Survey. Federal Reserve Bank of Dallas. https://www.dallasfed.org/research/surveys/des/2022/2201

Sanicola, L. (2022, June 11). US gasoline average price tops $5 per gallon in historic first. Reuters. https://www.reuters.com/business/energy/us-gasoline-average-pump-price-tops-5gallon-historic-first-2022-06-11/

The Budget and Economic Outlook: 2019 to 2029. (2019, January 28). Congressional Budget Office. https://www.cbo.gov/publication/54918

US Bureau of Labor and Statistics. (2022). United States Unemployment Rate [Data set]. https://tradingeconomics.com/united-states/unemployment-rate

Useem, J. (2019, July 22). The Stock-Buyback Swindle. The Atlantic. https://www.theatlantic.com/magazine/archive/2019/08/the-stock-buyback-swindle/592774/

US Energy Information Administration. (2022). Crude Oil Prices - 70 Year Historical Chart. MacroTrends. https://www.macrotrends.net/1369/crude-oil-price-history-chart

US Official Inflation Data. (2022). Inflation Rate for Gas between 1935-2022. Inflation Calculator. https://www.in2013dollars.com/Gasoline-(all-types)/price-inflation

Wilson, T. (2022, February 20). Big oil on course for near-record $38bn in share buybacks. Financial Times. https://www.ft.com/content/2852b800-4a03-4cf6-a47f-65c306a22657

Misinformed no more!

Appreciate the depth of the research and will share as often as I can to those who are misinformed, of which there are many.

What about other firms that do buy-backs? That is standard practice across industries. Completely irrelevant to the discussion. For example, Apple and other tech companies keep money offshore to avoid US taxes .Profits are the purpose of our capitalist system. Why shouldn't shareholders get profits? Investors who lost money with shale build out (billions) have never been compensated. Oil companies did not receive stimulus during covid when oil went negative. Exxon invested 118B on new oil supplies, 2x the net profits of 55B. https://corporate.exxonmobil.com/News/Newsroom/News-releases/2022/0615_ExxonMobil-statement-regarding-President-Biden-Letter-to-Oil-Industry